Saving for College

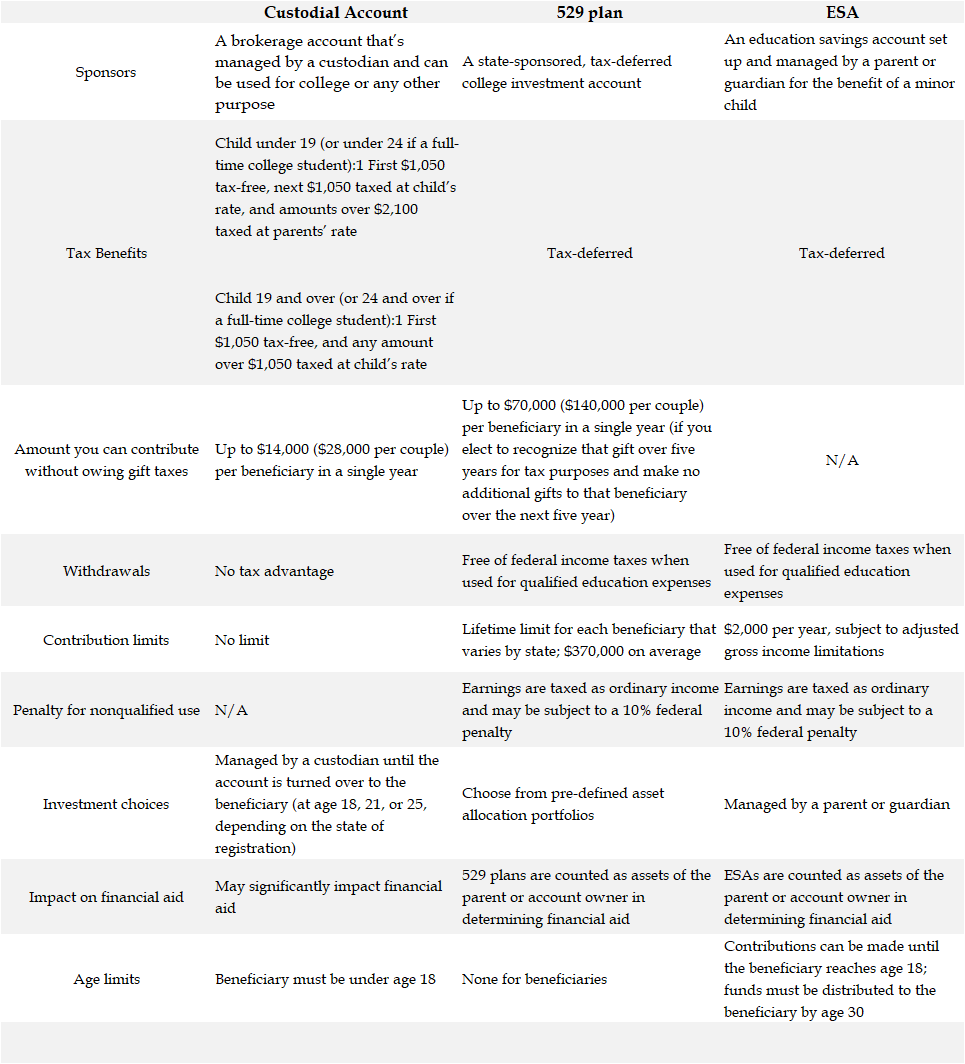

As the cost of higher education steadily goes up over time, it is important to save for a child’s college at his/her early age. Parents, grandparents, uncles and aunts can all help to fund a child 529 Education Savings accounts, which allow their donations grow tax-free while as donors, they have the control of the assets. For grandparents, your contributions to 529 Plan can be a part of estate planning as you can front load fives years contribution limits up to $70,000 per donor ($140,000 both grandparents combined). These contributions are excluded from your estate. As long as the funds are used for qualified education, the withdrawal is tax-free. However, for non-qualified withdrawals the earnings are subjective to federal and state income tax plus 10% penalty. Click the title link to find out more information on this topic. Consult your tax advisor for the related tax savings..

To find out each state's plan and rules, please refer to Morningstar's 529 state map.

Commonly Asked Questions

How college financial aid applications are evaluated?

Parental assets do not include your home, but do include:

1. Cash and savings and checking accounts

2. Non-retirement investment accounts

3. 529 Plans

4. Education Savings Accounts (ESAs)

A student's assets include:

1. Cash and savings and checking accounts

2. Non-retirement investment accounts

3. Custodial accounts (UGMA/UTMA)

are trademarks of Songbird Capital LLC.

are trademarks of Songbird Capital LLC.